Treasury

Payment Schedule

Tax Bills for the Municipality of Magnetawan are split into four (4) installments. The due dates for these installments are in March, June, September and November of the year.

Pay Your Bill

Reminders and Notices:

- Reminder notices are sent after each due date for properties with arrears exceeding $10.00.

- If you do not receive your tax notice, please contact the Treasury Department.

Important Note: Interest and penalties are applied to all unpaid property taxes starting the first day of each month following a missed due date. Failure to receive a bill does NOT relieve your responsibility to pay property taxes or any penalty charges.

Receiving Your Tax Bill via Email

You can now opt to receive your tax bills electronically instead of through traditional mail. This service is provided as an environmentally friendly alternative and may offer more convenience.

Sign Up for Email Delivery

To receive your tax bill by email, please complete our online request form.

Stay Informed with Municipal News

Don't miss out on important updates and information from the municipality. Subscribe to our electronic newsletter for regular insights and updates.

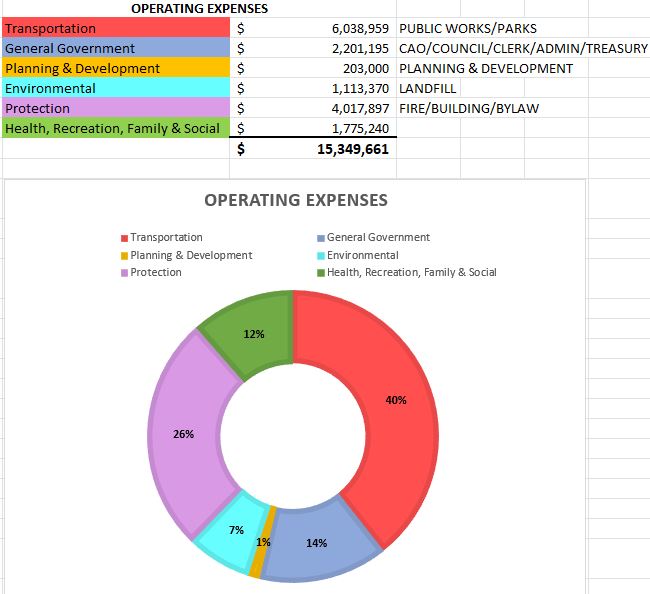

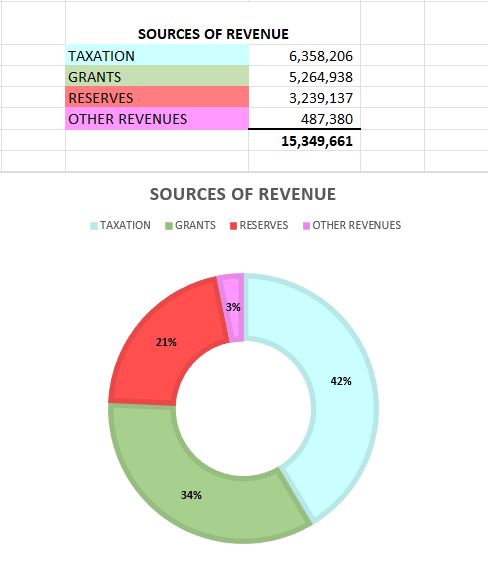

Current Municipal Budget for 2025

Stay informed about how your municipal funds are being allocated this year.

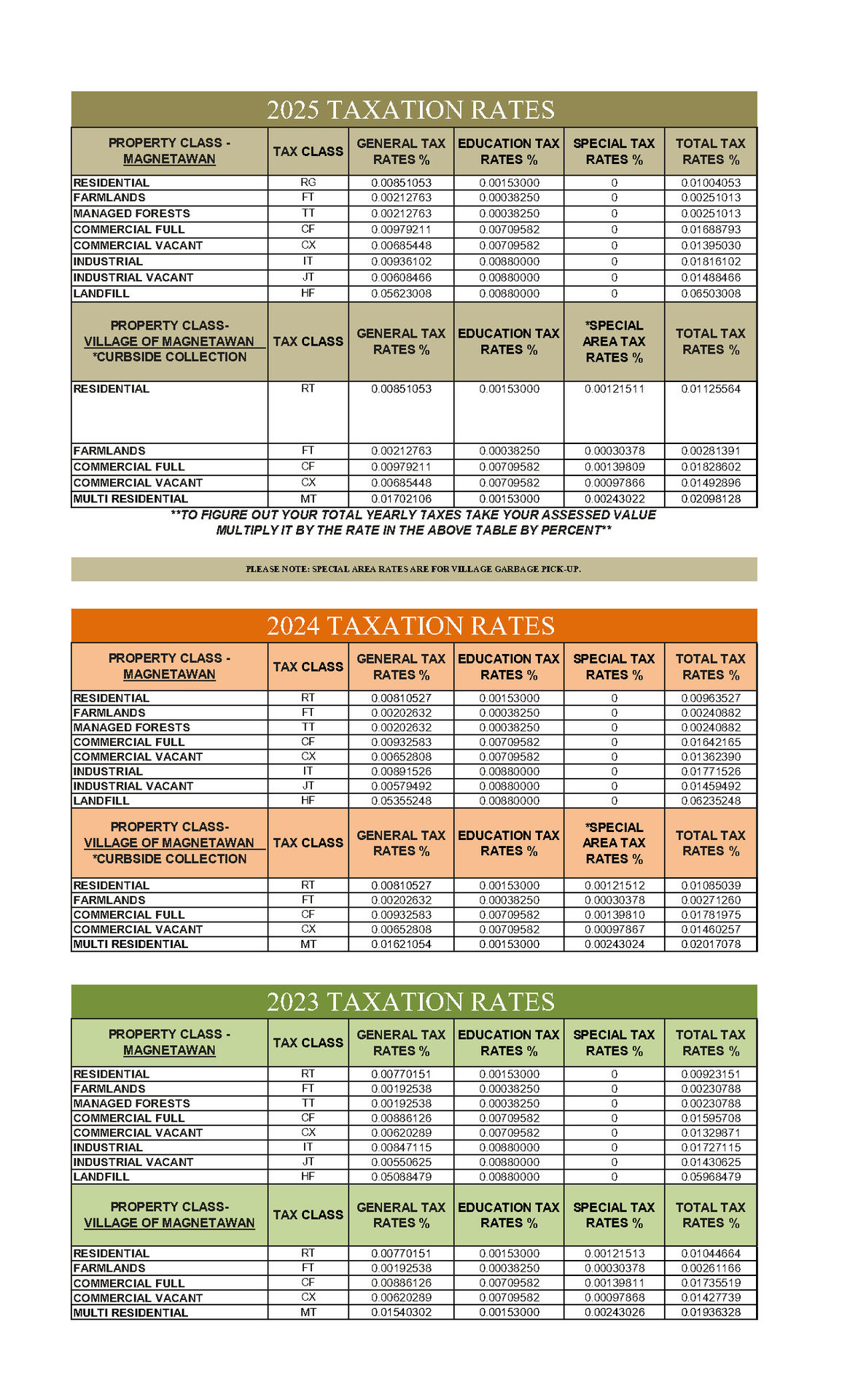

Taxation Rates

Asset Management Plan

Learn about how we manage and plan for the upkeep and enhancement of municipal assets.

View the Asset Management Plan

Frequently Asked Questions

Who do I contact about the assessment of my home?

The Municipal Property Assessment Corporation (MPAC) is the organization responsible for assessment for properties across Ontario. The municipality receives assessments of properties from MPAC. If you have a question or concern regarding your property’s assessment please contact the local MPAC office at 705-645-8994 or enquiry@mpac.ca

How do I change my mailing address?

Requests must be received in writing in order to change the mailing address on your property file. Please have the property owner contact the municipality in writing with the correct or new mailing address at info@magnetawan.com AND don't forget to include your permission for the Municipality to contact MPAC with the address change as well! OR fill our our convenient change of address request form!

How do I obtain a Tax Certificate?

To obtain a tax certificate, you will need to provide a written request and a payment of $50.00 per property roll number to the Municipal Office.

Will I still receive a tax bill if my mortgage company pays my taxes?

Yes! However it will be marked “COPY” so you have one for your records.

I didn’t receive my bill; what should I do?

If you did not receive your tax notice, please contact the Municipal Office immediately to ensure the mailing address on the property file is correct.

Information from MPAC

As you may be aware, the Municipal Property Assessment Corporation (MPAC) is working to implement legislated changes that will transfer responsibility for enumeration products for municipal and school board elections to Elections Ontario as of January 1, 2024. As part of this transition, VoterLookup will be decommissioned effective October 27, 2023. Visitors to VoterLookup will see the following message displayed:

VoterLookup has been discontinued. You are being re-directed to Elections Ontario’s Voter Registration service to confirm, update or add your information for provincial and local elections in Ontario.

New School Support Online Portal

As of January 1, 2024, MPAC is no longer responsible for collecting voter information for local elections. MPAC remains responsible for collecting information about school support. To update your school support information, visit MPAC’s online School Support tool.

About the new School Support Portal

The portal enables residential property owners to add or update their school support designation information through AboutMyProperty. Tenants registered with MPAC will follow a different path in the portal, similar to voterlookup.ca, to add or update their school support designation information. A Guide is posted alongside the portal, which provides users with step-by-step instructions on how to change or update their school support designation. The Guide is available in both English and French.

By making the process electronic, we improved the process for obtaining and accurately recording school support direction. It will also help improve the quality of school support data on the assessment roll.

Visit mpac.ca to access the Changing Your School Support

View the Direction of School Support Document

View the School Support Designation Toolkit